This years budget saw Chancellor Philip Hammond announce that stamp duty taxes on properties under £300,000 will be abolished for first-time buyers in an attempt to solve Britain’s housing crisis. However, this has been criticised by analysts and mortgage lenders alike who claim that this measure will not actually address the core problems in the housing market. For many existing homeowners, moving up the property ladder is hindered by large stamp duties, resulting in fewer available properties within a first-time buyers’ price range.

This is particularly good news for people looking to get on the property ladder in London, where on average first-time buyer spends £422, 000, compared to across the rest of the country where the average first house is around £200,000.

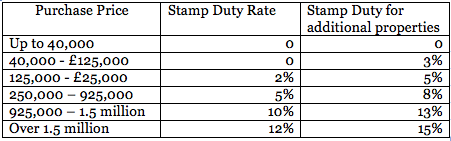

Existing and Second Homeowners Stamp Duty Rate

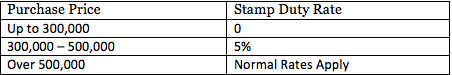

New First Time Buyers Stamp Duty Rate

This new rate means greater savings for buyers in the capital, particularly when taken into account that you will now only be charged stamp duty after £300,000 on a property costing up to £500,000.

Mr Hammond estimates that this will mean that 95% of first-time buyers will see a reduction in the amount of stamp duty tax they are paying, and 80% will pay none at all, with particular significance for buyers in London, where prices continue to sky rocket.

The Office for Budget Responsibility (OBR) estimates that the stamp duty tax cut will result in an additional 3,500 purchases by first-time buyers, with the chancellor insisting that young people will definitely benefit. Based on the average price of a first house in London, people will make an average saving of £11,000 thanks to the new tax cut, a considerable amount of saving for first-time buyers.

The new cut has faced criticism however, with many claiming that the saving is greatly out shadowed by the huge deposits first time buyers have to save up in order to take out a mortgage. With the average first house costing £200,000 outside of London, that’s only £1,500 to pay in stamp duty, which seems almost irrelevant compared to other costs. However, according to a study by the Centre for Economics and Business Research, current rates of stamp duty prevented 146,000 transactions in the past five years.

It may not be the intervention that many first-time buyers feel is needed, but the new tax cut will be sure to create savings. Whilst if the new tax cut will generate a housing boom for first time buyers in the capital is still yet to be seen, it is certain that money will be saved by it.

Contact London Building Surveyors

If you would like more information on stamp duty or would like to discuss the benefits of a property survey, you can contact our London office on 020 8257 5766 or click here to fill out our contact form.